A Qube Money Joint Account lets you share finances how you want, when you want, with whomever you want. And we’re excited to announce that Joint Accounts are now available to everyone!

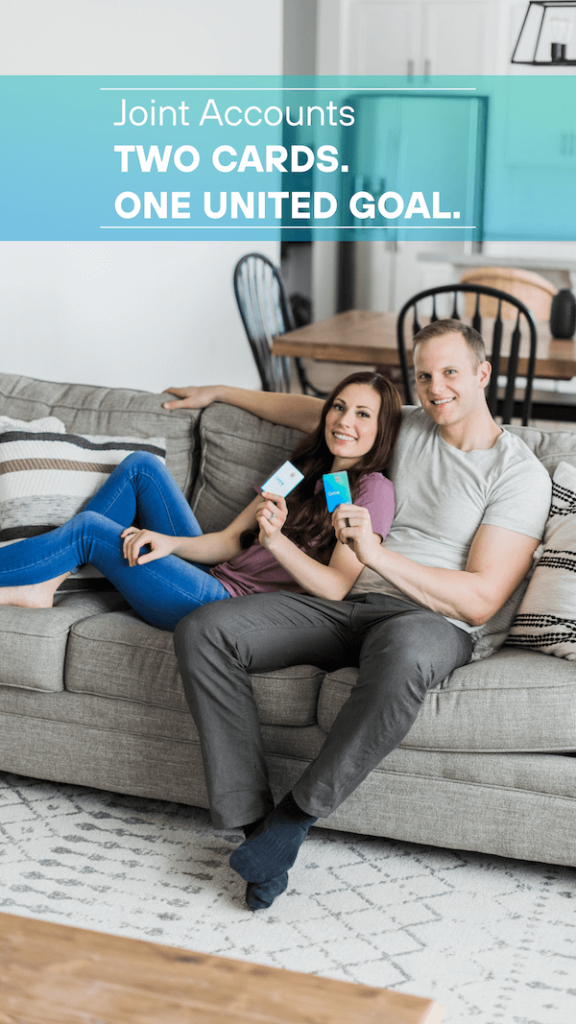

A Joint Account is a premium feature that allows you to invite that special someone into your financial life. When you have a Joint Account, you’ll both be able to spend and save using the same qubes. You’ll each have your own accounts with individual debit cards, but it’ll feel like the same account. This enables you to make decisions together, improve communication, and maintain a healthy financial relationship.

Why a Joint Account?

Money is the number one issue couples fight about. From advanced planning to real-time budget management, Qube’s mission is to unite couples by providing a solution that empowers financial transparency and seamless money management.

“Understanding the deep connection between relationships and money, we believe we can help couples collaborate and create transparency with money planning,” said Ryan Clark, CEO, and co-founder at Qube Money. “Living out this truth, we’ve set a goal to decrease the US divorce rate by 1%.”

The Joint Accounts feature allows you to better collaborate with your partner when making financial decisions. The app uses qubes, or digital “envelopes” that work in conjunction with a Qube Money debit card tied to your account. For couples, this means two apps, two debit cards, and one account.

When couples get paid, they proactively allocate their money to their budget plan via the qubes. This gives purpose and intentionality to their money. It frees couples to then execute the plan, knowing they both already agreed to it.

How Does it Work?

Qube’s proactive spending method, called “Tap to Spend” enables choice, allowing partners to select which qube they’re spending from with each purchase. The app then notifies each person on the plan regarding the qube used, the purchase amount, and the merchant name. This creates a line of open communication, so couples can stay on track towards their financial goals.

“While other personal finance apps focus on past behaviors, Qube is focused on the future and present,” said Shane Walker, executive vice president, and co-founder at Qube Money. “We’re transforming the environment of money, so you have the control of spending with cash and the convenience of a card.”

If you’re wondering if a Joint Account is right for you, take our quiz on this page. We think that anyone who shares finances with a partner or spouse, and who would like to manage household finances together, should create a Joint Account. If you’re married or dating and don’t want to share an account, you can always choose to keep things separate or have private qubes (coming soon).

How to Get Started

First, make sure that each person has their own individual account. If one person hasn’t created their own account, you can get started here.

Each person should go through the sign-up process like they would if they were signing up for their own account.

Second, decide who the primary user will be and set up your qubes and budget within the primary account. The secondary account shouldn’t have any qubes. If it does, the allocated funds will move to their Qube Cloud and then transfer to the primary account’s Qube Cloud.

To join accounts, the primary user will send a link to the secondary user. This will start the joining process. You can access this link by clicking here, or inside the app. Tap Profile > Accounts & Statements > Add a Companion.

If you have more questions about how Joint Accounts work, please visit our Help Center.