On January 7th, 2021, BBVA (the parent company of Simple Bank) announced that they would be shutting down operations for nearly 3 million Simple customers and transitioning them to BBVA.

In an email to all Simple users, the company said it was a “strategic business decision”.

I’ve been a customer since 2016 and fell in love with their brand and their focus on customer-centric banking. So much so that when I was in Portland, Oregon, in 2018, I made an effort to visit their headquarters, and someone from the company was nice enough to show me around the office.

Check out the video: https://youtu.be/4MDGkXA0vkU

As I was there, I even inquired about work opportunities, but, at the time, I wasn’t willing to move to Portland (if you remember, in 2018, working remotely wasn’t that popular).

Fast-forward two years and as a long-time customer myself and an admirer of what the company has built, I’m sad to see that it’s shutting its doors.

Related: Digital Banking – Strengths and Weaknesses of Online Digital Banks

What Do I Do Now as a Simple Customer?

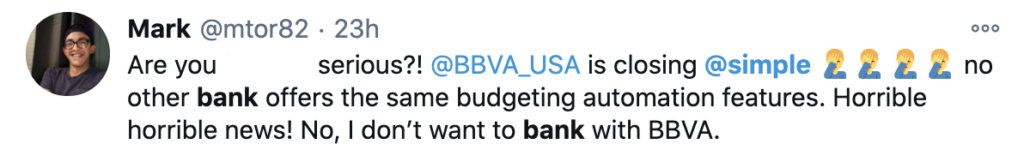

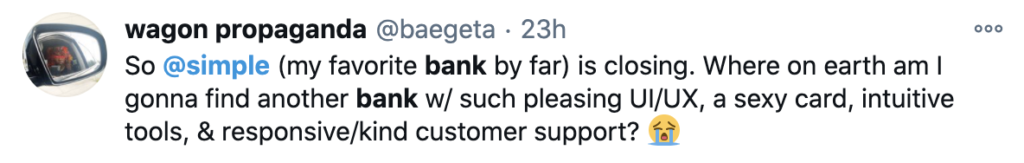

With all of the conversations happening on social media, many people feel the same as I do. I haven’t heard of anyone planning to stick with BBVA.

With all of the comments and conversations, many people are looking for alternatives. Here’s a spreadsheet that lists all of the banks that have similar banking and budgeting functionality as Simple that was started in a Subreddit.

In our humble opinion, we don’t think there’s another company that comes close to offering similar functionality, besides Qube Money.

In an article recently written by The College Investor, he said:

“The platform has the power to be one of the most transformative tools for spenders.”

Robert Farrington

Simple 10 Years Ago?

Qube Money is still in its early stages. We officially launched on January 29th, 2021.

It’s important to note; Simple is 10 years old. It took them a lot of time to get to where they are. If I remember right, I believe they only had 20,000 customers in 2014.

If you’re concerned about Qube Money not having EVERYTHING Simple Bank has, that’s ok. You can help us build Qube Money into the bank you want it to be. Imagine being one of the first 20,000 people to get to use Simple?

Even though we’re new, here’s what some of our users are saying:

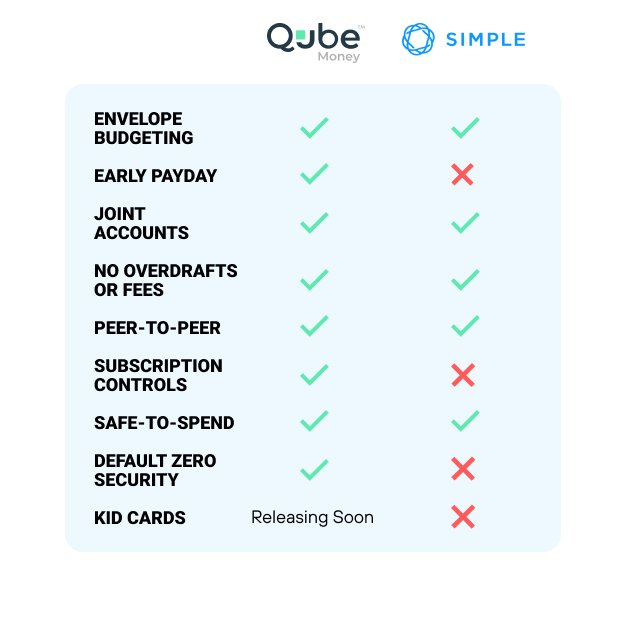

Qube Money vs. Simple

So what are the major difference between Qube Money and Simple?

Here’s a chart that breaks it down.

Envelope Budgeting

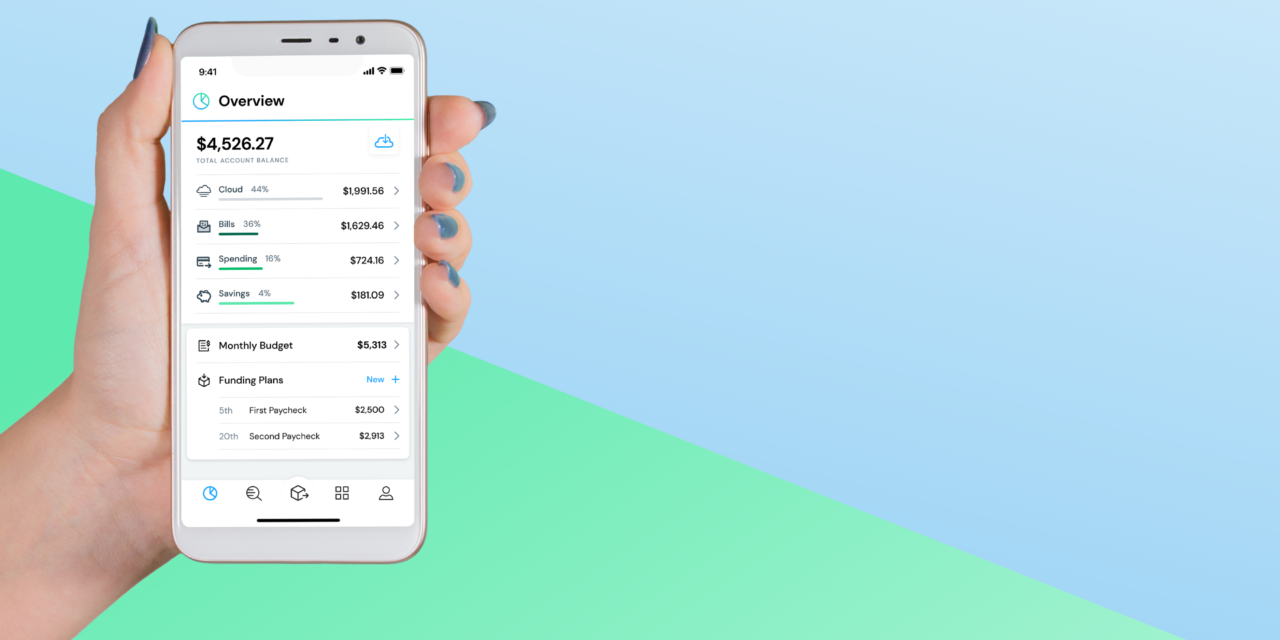

Envelope Budgeting is the ability to divide up your money into different accounts (envelopes) for different spending purposes.

Instead of all of your money sitting in one checking or savings account (which leads to waste), dividing it up gives your money purpose and helps you be more intentional with your spending.

Early Payday

Qube Money allows customers to get their direct deposit up to 2 days early. If you’re a W-2 employee and get paid via direct deposit, you can set up payday 2 days early.

Setting up direct deposit is easy. You’ll first need to provide your routing and account number to your HR department. Depending on how your company sets up direct deposit, you can choose to fill out the form yourself and give it to them, or you can choose to email the form directly to your HR department.

Next, choose the deposit amount. It could be part of your paycheck, or all of it.

Most banks wait until payday to give you access to your money even though employers typically process payroll a few days before payday. Early payday means you can get paid the day payroll is processed, giving you earlier access to your funds.

Joint Accounts

Joint Accounts allow you to invite a special person into your financial life by spending and saving from the same qubes. You’ll each have your own individual accounts with individual debit cards but it will feel like the same account.

This feature is for anyone that shares finances with a partner or spouse that would like to manage the household finances together. If you’re married or dating and don’t want to share an account, you can always choose to keep things separate.

No Overdrafts or Fees

Our system prevents overdraft or non-sufficient funds (NSF) fees. Since you won’t be able to spend more than the total amount in the “envelope” you’re spending from, your account balance will never fall below zero or trigger an overdraft fee.

Many people speculate that one of the reasons Simple is shutting down is because they weren’t profitable. And one of the reasons they weren’t profitable was because they didn’t charge overdraft fees. Overdraft fees are a $34 billion dollar industry. And just like Simple, we don’t charge them.

Peer-to-Peer

A peer-to-peer money transfer is when you use Qube Money to transfer funds from one person to another over a mobile network. Instantly send money to another Qube user. As long as the person you’re sending money to has an account with Qube Money, you can send money any time of the day. It works the same as Simple, Varo, Venmo, Zelle, etc.

Owe your friend money? Need to split a bill? These are a few of the many cases where you can send money to your peers instantly. When you go to transfer money, select “send to another Qube user” make sure you input the correct phone number or email, and choose the amount you would like to send.

High-Yield Savings (Coming Soon)

This is a feature coming at some point in 2021. It will be a competitive rate for savings qubes.

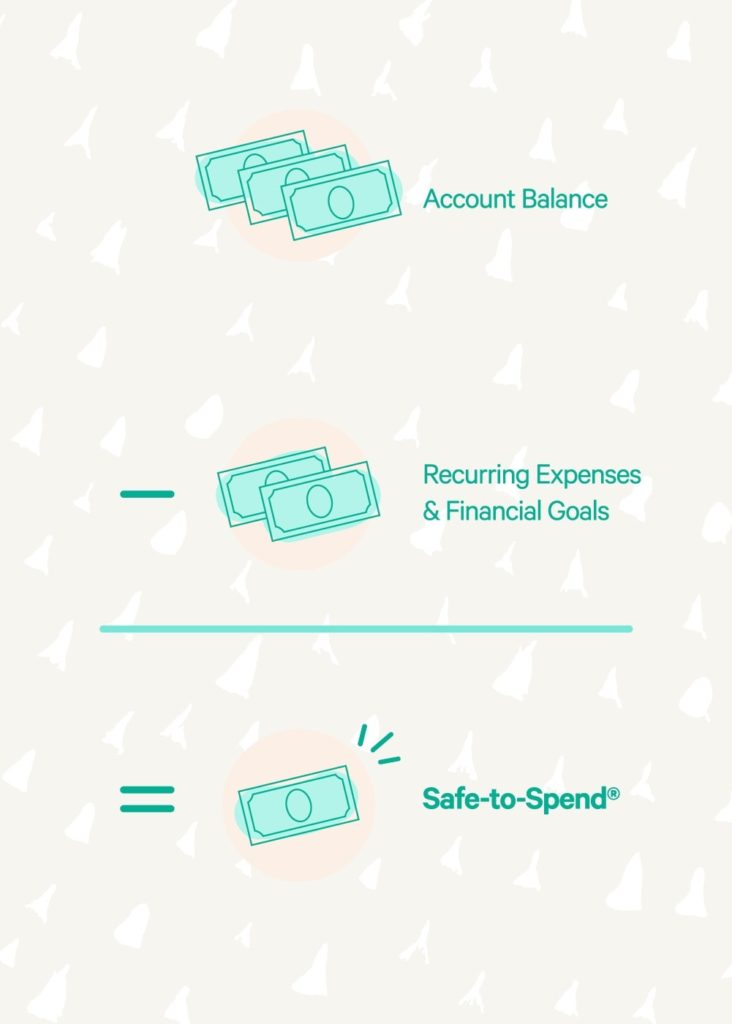

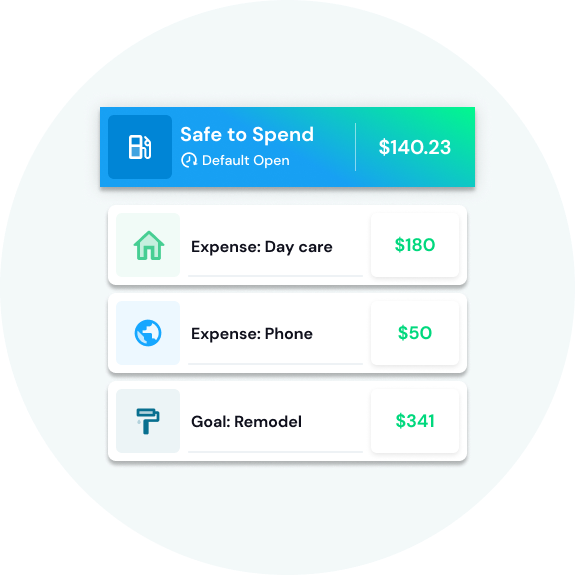

Safe-to-Spend

Simple Bank’s “Safe-to-Spend” helps you understand how much money you can spend. The formula is Account Balance minus Expenses and Goals equals Safe-to-Spend.

At Qube Money, we do things a little bit differently, but you can set up this same system within our app.

First, you have “Total Available to Spend.” This is the total amount of money that has been divided up into your qubes. If you create a Default Open Qube (Safe-to-Spend), this can be a place to house any extra money that is safe to spend. For example, if you create a few goal qubes and a few spending qubes, you can transfer any remaining funds to your Safe-to-Spend qube automatically.

Lastly, you can now choose to keep this qube open at all times.

We like to say, “Treat yo’ self (with limits).”

Default-Zero Technology

The Qube Card is engineered so you’re the only one who can use it. Default Zero* technology requires a qube to be opened from your phone for transactions to be approved.

* All money deposited in Qube Money is held with our bank partner, Choice Financial Group, Member FDIC. The Qube Money Card is issued by Choice Financial Group, Member FDIC, pursuant to a license from Visa.

Being a Simple Bank customer myself for many years, and knowing how similar Qube Money is (and can become), we’d encourage you to just try us out.

We know how hard it can be to switch banks and we want to make the process as seamless as possible.

Read: How to Switch Banks (6 Ways to Get Started)

To get signed up for a Qube Money account, click here.

We’re here to help you make the transition, so if at any point you have questions or concerns, don’t hesitate to reach out to our customer support team through the live chat or by sending an email to support@qubemoney.com.