Life is expensive. You may be trying to pay for college, manage household finances, raise children, or start your own business. But there’s nothing like a negative bottom line to send your goals hurtling back to square one. But we’re totally here to help! Today we’re talking about which is the best budgeting app if you want to reach your goals and find financial peace.

Technology has made spending money easier than ever before. It can even seem like money isn’t real. Take credit cards, for instance. When we spend with a credit card, it doesn’t register to our brains that we’re spending anything.

Studies show that when people use credit cards, they spend way more than if they were using cash. Up to 83-100% more! For most Americans, that is $18,000+ a year spent on nonessentials! (What could you do with an extra $18,000?)

Plus, the advent of smartphones has made it so easy to spend. No more carrying around cash to buy things…just pull up your Amazon app and order whatever it is you’ve been wanting. I order my groceries online. I even recently heard about an app that lets you buy your car online!

While these options can undoubtedly make some aspects of life easier, they may not be making it better.

You don’t have to let technology drag you down into debt and disorder. There are tons of financial, banking, and budgeting apps and tools that can help you. But do you really need to budget? And what is the very best budgeting app, if you’re serious about changing your financial life?

Budgeting Doesn’t Have to Be a Dirty Word

OK, I have to say it. Budgeting is more important than ever (cue sense of dread).

But, let me guess…you’ve tried the whole budgeting thing before. You’ve spent countless hours preparing, tracking and reviewing your budget. You’ve tried a myriad of apps and tools.

You probably started out committed, even excited about the prospect of reaching your financial goals. But then, you began to slip a little. You pick up a Starbucks, find a deal on a cute pair of shoes, eat out a little more. Or maybe you have one of those “it’s been a rough day, and I deserve a little pampering” days.

Maybe you started diligently tracking every day, then that became every other day. By the time the end of the week rolled around, your time was up and your budget was out the window.

With budgeting, it’s so easy to find yourself thinking, “I wish there were an easier way to do this.” Um, news flash: there is.

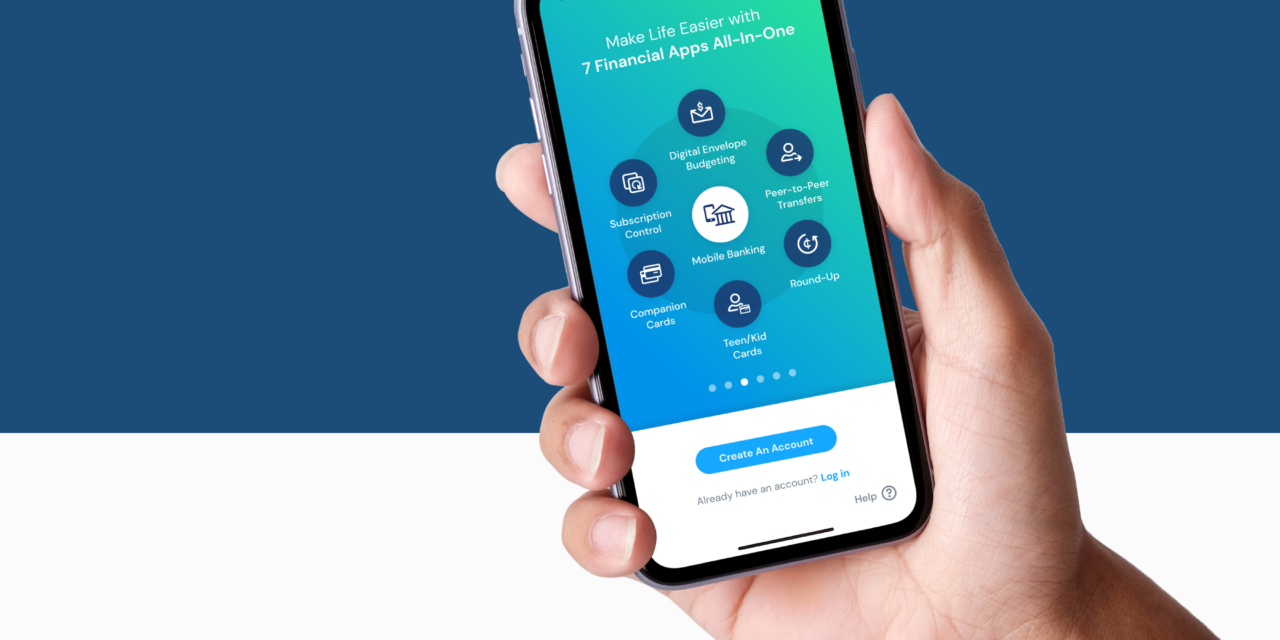

Let me introduce you to Qube Money. Qube is the only app that connects digital payment technology with the age-old cash envelope spending method (think Dave Ramsey). It is, quite simply, the best budgeting app if you’re serious about changing your finances and your life.

No more end-of-the-month money anxiety, no more tracking expenses. No more watching your dreams implode upon reentry and disappear somewhere off the coast of Mexico.

Here’s How Qube Money Works

First things first: sign up for Qube Money. You’ll receive a Qube checking account, a debit card, and access to the Qube Money app. Once you’re in the app, set up your qubes (these are like the envelopes from Dave Ramsey’s cash envelope system).

These qubes represent your bills, savings, and spending categories. You might have a grocery qube, an entertainment qube, a gift qube, an Amazon qube, and a mortgage qube. Once you’ve named your qubes, you’ll assign a dollar value to each one, a value that represents your budget for that category.

Like physical cash envelopes, Qube Money requires you to give every dollar a job. Once each category is budgeted for, you’re ready to go. You’ll then look at your budget before spending (every time!), and then spend with purpose, from your budget.

Stopping to think before you spend will make your money seem real again. And when your money seems real, your behavior around money will begin to change.

You can see how using the Qube Money app makes it easy to stick to your budgeting goals! It’s simply the best budgeting app for behavior change.

Once your money is deposited into Qube Money, you’ll be prompted to allocate your money into your qubes. You can also set up the allocation process to happen automatically for each budgeting period. This will make your life so much easier!

Related: Other budgeting apps not helping with your money goals? Here’s why.

Time to spend!

To spend from your spending qubes, you just tap the balance in the qube you want to spend from, and the money from that qube is immediately available on your debit card. After the transaction, the debit card returns to a default zero balance and the transaction is automatically legered. To spend again, just tap another qube and the balance of that qube is available on your card to spend. At the end of the budget period, you can set each qube to roll over to the next period automatically. Or you can sweep the extra money to a savings goal (i.e. debt elimination, or another goal you’re working on).

Through your bill qubes you can automate bill pay, subscriptions, and view your transaction history inside the app. You can also turn off subscriptions and automatic payments coming from your account, anytime. You are in control, not the vendors who have your account information.

Savings qubes show you the progress you’re making towards your important goals, with total clarity. Say you have set a goal as a family to go to Disney World. You can budget money each month to go straight into your savings qube automatically. When you reach your goal, you’ll convert your savings qube to a spending qube. Then you’re ready to start building memories with those you love.

This form of budgeting sound a little too rigid for you? Qube allows you the option to select a default open qube. This qube will always be ready to spend as long as there’s money in it. If you want to spend from another qube, simply open the qube and your app will temporarily close the default open qube until the selected qube closes. Qube also makes it easy to reassign transactions from one qube to another. This is nice when you want to manually categorize transactions in your default open qube.

The Best Budgeting App for Your Relationship

As if the spending methodology isn’t enough, Qube Money provides budgeting for the entire family. Couples can join their accounts and create private qubes and shared qubes. Shared qubes have options like Partner Permissions and Partner Notifications so couples can work together toward their financial goals. Partner Permission requires in-app approval by both partners for money to be spent or transferred from a qube. These permissions can be turned on or off for each shared qube. Partner Notification alerts both partners when a qube is opened, how much money is spent and where money is spent, in real time. Notifications can also be turned on or off. Imagine being able to manage money as a couple on the go!

Those partner permissions keep you from skipping out on your goals, and they might just save your marriage.

Did you know that money is the #1 cause of stress in America? Research shows that 7 out of 10 couples report that money causes tension in their relationship. Not only that, couples who argue about money at least once a week are 30% more likely to get divorced.

If those numbers have you shaking in your boots, don’t worry. Qube Money can help you be certain that you and your partner are always on the same page when spending money. You set your financial goals together, and you can even choose to keep each other accountable through spending requests. Who knows? You may never need to have another money fight.

Related: Get your spouse on board with budgeting!

The Best Budgeting App to Teach Your Kids Healthy Spending

Handling money with your partner is hard, but handling money with kids? Arguably harder. Your kids learn about money through you. They see your spending habits, they hear what you say about money…and they often adopt your attitude toward money. Teaching another human being how to look after their finances is a big responsibility!

As we discussed before, money is no longer real and tangible. Our kids see us pay for groceries, shop online, and transfer money to friends…all from our phones! Even at Disneyland, they only need a wristband to buy to their heart’s content. They only see the ease of getting things they want, not the consequences of overspending and debt.

Qube Money can lighten the load in the parenting department, too. It’s the best budgeting app for teaching kids positive money behaviors. Qube applies the same behavior-changing methodology in our kids’ accounts as it does for adults. Just like a regular qube account, a kids’ account is designed to help kids think before they spend.

As part of our family features, we’re planning to offer families up to 10 kid cards and a “kid view” in the app. Included in the kids’ features will be chore tracking, payment requests for chores, and the same exact Qube budgeting system. Parental permissions will shape your child’s understanding of money. With your guidance, they’ll know how to effectively save money and when the time is right to spend it.

When your kids use the app every day, they get a hands-on financial education. Qube Money makes it easy to teach kids healthy spending habits. These habits will set them up to achieve their financial goals.

[Kids’ and family features are a Coming Soon feature of Qube Money.]Safe and Sound

Qube Money takes even more of the stress out of money with an FDIC insured account and built-in security features. Think about it—with Qube, you’ll never have to freeze an account again. Qube is simply the best budgeting app…it actually makes your bank account more secure!

If your card falls into the wrong hands, no problem! Your default balance is already zero if you don’t have a default open qube.

Let’s say someone steals your card details. The only way a criminal could access your money would be if they managed to steal your phone, hack into your phone, and hack into your Qube Money app. If all of those things happen, you should consider investing in a rabbit’s foot—or at least search the nearest field for a four-leaf clover.

If you are really paranoid… you always have the option to have partner permissions on all of your qubes. In that case, if a thief were able to open that qube, a request would still be sent to your qube partner to approve or deny—denied!

Qube Money is the Best Budgeting App

If you’re trying to save up for something big, end to fights about money, reduce your stress, or teach your children how to think about money, Qube Money can help.

Budgeting shouldn’t be about what you can’t have; it should be about what you’re working toward. A budget allows you to spend money on what matters most to you, and cut out the things that don’t. With Qube Money, money is an asset, not a stressor. You can stop watching unnecessary expenses drain your bank account.

So, are you with me? Is Qube Money the best budgeting app of 2021? Try it out.

![Everything You Need to Know About the Cash Envelope System [+ Sample Budget]](https://blog.qubemoney.com/wp-content/uploads/2020/01/1-20-20-the-cash-envelope-system-blog2-440x264.png)