If you’re like most people, you’ve never thought about creating bank account nicknames. A standard checking account and savings account does the trick for most US-based banking customers.

But that’s not you. You’ve come here today because you understand the importance of dividing up your money for different purposes and giving each dollar a job.

Read: The Main Difference Between Proactive and Reactive Budgeting

When all your money sits in one location, like a checking account, it’s easy to overspend. If your balance is $5,000 and you want to spend on travel, as long as you don’t spend more than $5,000, you’re good, right? What if you overspend on your trip, and when you get home you realize you don’t have enough to pay for necessities? Then what?

Most people will put the extra needs on a credit card because there aren’t enough funds in the checking account to cover ALL expenses.

That’s why it’s important to divide up your money and give it purpose. How would things change if your travel budget was $500 and you set it aside in a separate account or a sinking fund? You now know you can’t spend more than $500, or you won’t have enough to cover your other expenses.

Why Create Separate Bank Account Nicknames?

According to economist Richard Thaler, who coined the term “mental accounting,” it’s beneficial to categorize our expenditures for certain purposes. Mental accounting deals with the budgeting and categorization of expenditures. People budget money into mental accounts for expenses or expense categories.

Related: Can Mental Accounting Hinder Your Financial Goals?

When we perform the act of dividing up money for different expenses, bills, and savings goals, we’re more likely to stay within those limits set. Saving money and sticking to a budget becomes easier as a result.

If your bank allows you to create multiple bank accounts for free, you should create nicknames for your different accounts. However, if your bank is going to charge you a fee or ask you to meet certain requirements to avoid the fee, you could either:

- Leave your bank and find one which allows you to have unlimited bank accounts for a nominal membership fee. (This is common at credit unions.)

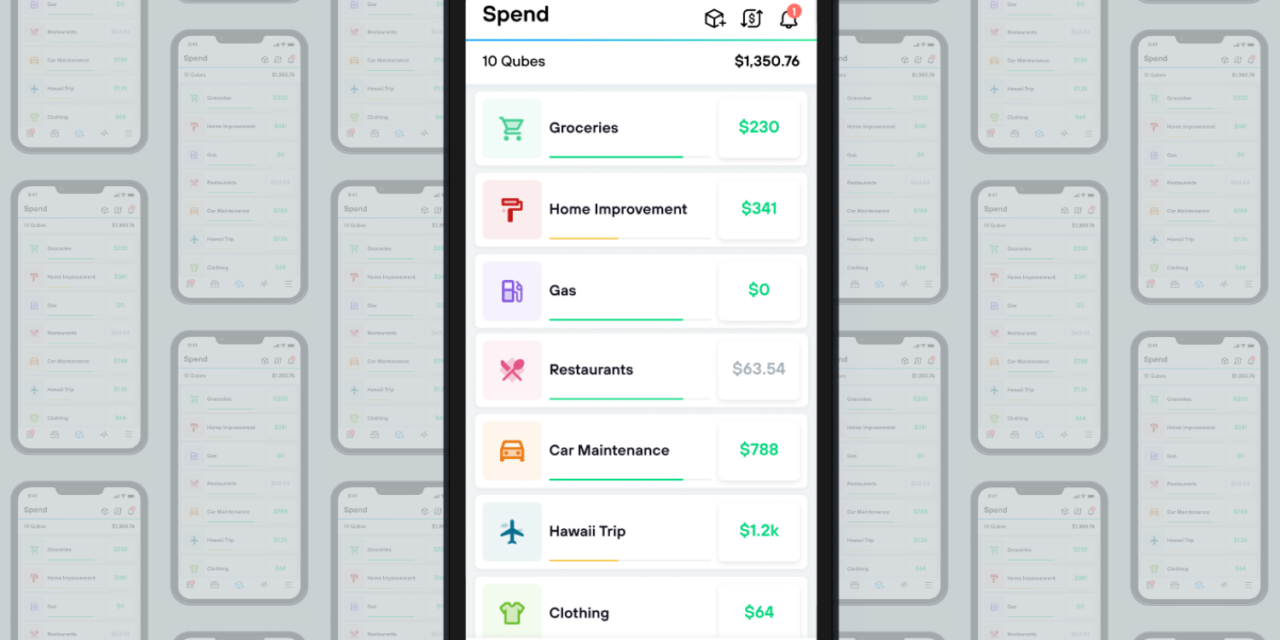

- Sign up for Qube Money, where you can create 3 qubes (accounts) with the free Basic plan and unlimited qubes with the Premium version.

Note that credit unions user interface and banking features are often outdated. This can be frustrating when you’re trying to send wires or connect external accounts to make moving money easy. Qube Money is a banking app with an interface designed to help you divvy up your money and follow your plan.

Examples of Bank Account Nicknames & Names for Qubes

Food & Groceries:

- Food & Dining

- Bulk (Sam’s Club/Costco)

- Eating Out

- Food

- Nourishment

- Daily Bread

- Groceries

- Work Lunch

- School Lunch

- Snacks and Drinks

- Costco Membership

- Fill My Belly

Home:

- Taxes

- Mortgage & Rent

- Utilities

- Internet

- Insurance

- Home Improvement

- Kitchen Remodel

- Furnishings

- Home Decor

- Lawn & Garden

Transportation:

- Gas & Fuel

- Car Registration

- Car Insurance

- Wheels on the Bus

- Car Payment

- Car Wash/Detailing

- Public Transportation

- Car Maintenance

Personal Care:

- Self-Care

- TYSF-Treat Your Self Fund

- Treat Yo’ Self

- Spa Day

- Haircuts

- Dry Cleaners

- Laundry

- Toiletries

- Pamper Me

Misc.:

- Rona Revenge

- Swear Jar

- Fun Money

- RAM (Random Access Money)

- Birthdays

- Hunting Season

- Kid #1

- Kid #2

- Children

- Monthly Buffer

- Cash (Unaccounted For)

- Office Supplies

- Kids’ Allowance

- Side Hustle

- Legal

- Education

- Life Insurance

- Render Unto Caesar (Taxes)

- Tuition

- Books

- Student Loans

- His Fun Money

- Her Fun Money

- That Terrible Thing I Want to Quit

- Achilles Heel

- Safe to Spend

- My Extra Dough

Shopping:

- Amazon Addict

- Amazon Prime

- Clothing

- Books

- Software

- Hobbies

- Amazon Orders

- Sporting Goods

- Gadgets & Gizmos Aplenty

- Shiny Things

Pets:

- Pet Food

- Vet Bills

- Grooming

Vacation:

- Camping

- Road Trip Funds

- Hotel Room

- San Diego Adventures

- LegoLand

- Hotel

- Air Travel

- Rental Car & Uber

Saving:

- Savings Challenge

- Banana Stand (there’s always money in the banana stand)

- Not Safe to Spend

- Alpaca Farm Fund

- Retirement

- 401(k)

- Roth IRA

- Cryptocurrency

- Investments

- 529 College Funds

- Emergency Fund

- Can’t Touch This

- Winter is Coming

- Peace of Mind

Bills & Utilities:

- Medical Fund

- Georgia Power

- Water

- Cell Phone

- Internet

Entertainment

- Amusement

- Arts

- Movies

- Music

- Magazines

- Netflix & Chill

- Pokemon Master

Gifts & Donations

- Charity

- Gifts

- Philanthropy

- Tithing

- The Lords Chips

- Christmas

- Birthdays

- Anniversary

- Holidays

- Wedding

- Give it Away Now

- Seek Ye First

- Better to Give

Health & Fitness

- Dental Insurance

- Dentist

- Doctor

- Eyecare

- Gym

- Health Insurance

- Pharmacy

- Sports

- Supplements

- Doctor, Doctor, What’s the News?

- Down With the Sickness

Kids

- Allowance

- Baby Supplies

- Babysitter & Daycare

- Child Support

- Diapers

- Formula

- Kids’ Activities

- Toys

How to Create Multiple Bank Account Nicknames

Similar to writing on an envelope or putting money in a piggy bank, get started nicknaming your different accounts today. You might think these are great bank account nickname ideas, but if not, take the time to rename yours. Here at Qube Money, we want to challenge you to take a few minutes to change the names of your accounts or qubes. And if you need to create more for important budget categories in your life, now’s the time. Take a few minutes to nickname your accounts or qubes today!

Conclusion

When you give your money purpose, you’re more likely to reach your financial goals and save money. And it could be as simple as creating bank account nicknames or multiple qubes. If you’re looking to make the process easier and even add colors and icons to your different accounts, sign up for Qube Money today!