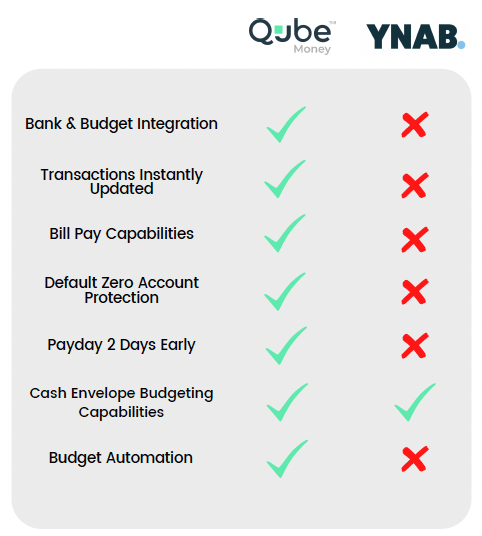

A budgeting app can make life easier, but because the app store is packed with them, it’s hard to know which one to choose. If you want to stick to your budget and want the help of an app, you may have narrowed it down to YNAB and Qube Money. This article is here to help you make your choice!

You Need a Budget (YNAB) has been a big daddy in the budgeting app world for a while. It’s a spreadsheet-based website/app combo that helps you set up your budget in categories and track your expenses.

A newer app with a growing reputation, Qube Money is an app/debit card combo that unites your bank and budget in one system. Similar to YNAB, your budget lives inside the Qube Money app. The difference is that when you use your Qube Money debit card, you’re spending straight from the budget you’ve created.

Below, we’ll answer five questions, to help you understand which of these two is best for you.

- What’s the user experience?

When you use YNAB, you’re primarily using it to create budget categories, prepare for upcoming expenses, and track the balance of your current budget. YNAB also syncs with your bank and credit card accounts to import your spending information. Transactions from your accounts can also be manually entered.

Qube Money was built around the cash envelope method of budgeting. It combines a digital envelope experience inside the app with its own debit/credit card. Your account with Qube is a literal FDIC-insured checking account that’s separate from your other spending accounts. This account can be divided into as many “sub-accounts” as you need. These sub-accounts are called “qubes” and they are the spending categories (“envelopes”) of the budget you’ve set up inside the app.

Wanna see how Qube Money works? Click here.

- What about overspending?

Unless you stay focused, YNAB’s interface allows you to ignore your budget. Your spending activities are completely separate from the budgeting and planning you’re doing inside the app, so it’s possible to lose sight of the goals you’ve made when you’re out spending. If you do exceed your budget, you only end up confronting this financial boo boo after the fact, when it’s too late.

Qube Money is a more effective form of budgeting since your budget inside Qube Money is also your spending money. Every time you spend, you’ll need to select the budget category you want to spend from, before you run your card. When you look at your budget before you spend, you can make a more informed choice in the moment, instead of regretting it after the fact.

- How hard is it to maintain?

If you want your budget to be accurate inside YNAB, you’ll need to make sure all your transactions are reflected in your YNAB account. Even when your spending accounts are linked to YNAB, transactions will take some time to be reflected in your YNAB account (24 hours, or sometimes longer). It’s even possible that some of them may slip through the cracks. This means that you’ll need to regularly devote some time to making sure all your transactions are reflected inside YNAB.

Qube Money’s bank/budget combo removes the need for manual tracking or double checking balances. Transactions are recorded directly into your budget (because it’s your bank), and balances are updated in real time. When you spend $50 of your $500 grocery budget, you’ll see that there’s $450 left to spend, immediately after you make the transaction.

- How hard is it to learn?

Starting your budgeting journey can be overwhelming, especially if you haven’t tracked your spending in the past, are in debt, or are spending more than you earn. Although YNAB’s philosophy is sound, there’s a lot to learn. That kind of effort required at the outset can be a barrier to entry for some, especially someone who’s already overwhelmed with money management.

When you adopt Qube Money, there is some effort up front. You’ll be asked to create a simple budget, set up a Qube account, and input your budget into Qube. Once that initial work is done, this is where Qube Money shines. The work required to maintain and stick to your budget can be as little as 5 minutes a month. (Pretty darn easy!)

- What does it cost?

YNAB allows you to try their service for 34 days for free. After that, a year’s worth of YNAB is $84 (which ends up being $7/month). If you’d rather pay per month, YNAB is $11.99/month.

The pared-down (but still powerful) Qube Money Basic Plan includes your own Qube bank account (with a Qube card), 10 spending categories (qubes), Apple/Google Pay capabilities, peer-to-peer transfers (similar to Venmo), and Qube’s default zero technology…completely free.

The Qube Premium Plan includes everything above, plus unlimited qubes, recurring transfers, couples features, and additional budget automation capabilities, for $6.50/month.

Which should you choose?

If you’re super enthused and would like to dive deep into tracking and planning, YNAB may work for you. But unless you’re ultra-motivated, after a while, all that tracking will probably get old. Plus, YNAB leaves plenty of room for error. Putting in a ton of work and still overspending (plus paying more money just to use it)? Hard pass.

If you’d like to maximize your chances of spending wisely, and want to do it easily, Qube Money is the one for you! Qube’s combination of banking and budgeting facilitates way less overspending (just like cash envelopes), and user upkeep is minimal compared to YNAB (and many other budgeting apps).

In terms of value, Qube Money has the obvious edge. Qube’s life-simplifying automations, its bank/budget integration, along with its super low price makes it the clear winner. You can’t beat free!

If you want to try the Qube experience, click here to download the app and try it today!

Does finding out your unique purpose for money sound like your jam? How about creating a money plan to fulfill that purpose? Or creating generational wealth for the rest of your life? If so, check out our Qube Masters course! Qube Masters works together with Qube Money to maximize your chances of financial supremacy. Click here to check it out!